If you and your team are the heart of your business, then cash is the oxygen.

Without cash and more specifically positive cash flow, your business will die.

Your cannabis business can be a cash-flowing business but the unfortunate reality is that you have an additional burden. It’s 280e. In short, 280e is a federal tax code that says a federally illegal business has to file taxes yet isn’t allowed to deduct any expenses. You also can’t take any business tax credits.

Here’s a quick example of the effects of 280e:

Understanding Cash Flow

With this additional burden, managing cash flow becomes more vital to keeping your business alive. But what is cash flow?

Simply put, cash flow relates to the net amount of cash moving in and out of your business. Cash spent is considered cash outflow (money paid for bills, to vendors, payroll, etc.) Cash and cash equivalents received are considered cash inflow. The total of these two types of transactions is your net cash flow. This shows you if you are bringing in more cash than you pay out or if you’re dishing out more cash than you bring in. As you can imagine, the latter is a recipe for disaster.

Managing and prioritizing cash

Naturally, you begin to wonder, “How do I successfully manage this cash?”

Review regularly

The first rule in managing your cash flow is to use proper cannabis accounting. The second rule is just as important, pay attention to it regularly. This means reviewing your expected cash position for the next week, next month, and the next few months. Avoiding the excess spending and the all of a sudden low cash balances that plague businesses are virtually impossible to do without reviewing cash reports and forecasting your cash for the future.

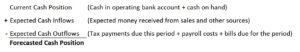

Here’s a simple formula to get a good picture of your cash flow for the near future:

Prioritize who you pay

A critical component of managing your cash flow is prioritizing how you will spend it. Sometimes cash dips lower than you would want it, requiring you to determine when and who you should pay first. Let’s look at some of the most important areas you need to prioritize paying:

- Taxes

- Sales/Excise

- Income Tax

- Site costs

- Rent

- Utilities

- Insurance

- Other operating expenses

- Vendors that you buy your inventory from

- Payroll

- Other selling, general, and administrative costs

Stash some cash

Unexpected things happen (remember 2020?). Just like it is wise for every other industry of business to save, cannabis businesses should have savings accounts to stash some cash for rainy days. This allows a cannabis dispensary or cannabis cultivation to quickly bounce back when new equipment is necessary, a natural disaster disrupts your business, a season of lower sales, etc.

It’s recommended to have 2 months of liquid cash saved up to cover your normal monthly costs. Imagine having the peace of mind as a cannabis business owner, knowing your business is financially healthy even in times of sudden business interruptions. The 2-month amount should be your goal. If that’s too much in one period, start slow and build up. One percent of that amount can be put away beginning today. A bonus tip is adding this amount to your cash flow forecast. Rock solid cannabis accounting along with a proactive accounting team should help make this process easier.

Cash managing tips

Let’s run off a quick list of things you can do starting today to better manage your cash flow and become financially healthy:

- Know your inventory lifecycles to maximize your purchasing efficiency

- Have good bookkeeping to quickly pull a cash forecast each month or each week

- Begin building your rainy day stash

- Outsource (a full finance department can run you $200K+ along with additional costs of payroll taxes and benefits compared to $60K+ for an outsourced team of a CFO/controller, accountant, and a bookkeeper)

- Build relationships with your vendors to receive discounted net terms.

When there’s a will, there’s a way

Cannabis businesses regularly see large influxes of cash. Unfortunately, so much is eaten up by 280e income taxes and state/local taxes. But when there’s a will, there’s a way. And that way is through planning ahead, forecasting, and routinely reviewing your expected cash flow. Get ahead of your finances with the help of a complete cannabis accounting and advisory team today. Ready to get support? Begin your journey today!